Buying and selling

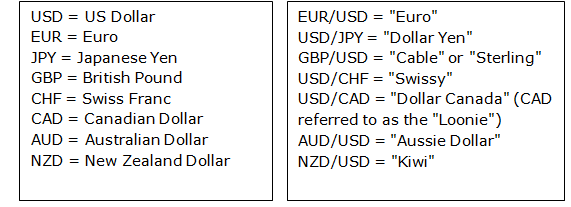

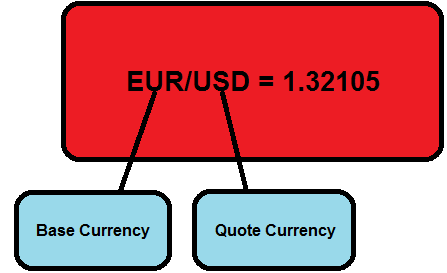

The basic idea of trading the markets is to buy low and sell high or sell high and buy low. I know that probably sounds a little weird to you because you are probably thinking “how can I sell something that I don’t own?” Well, in the Forex market when you sell a currency pair you are actually buying the quote currency (the second currency in the pair) and selling the base currency (the first currency in the pair).

In the case of a non-Forex example though, selling short seems a little confusing, like if you were to sell a stock or commodity. The basic idea here is that your broker lends you the stock or commodity to sell and then you must buy it back later to close the transaction. Essentially, since there is no physical delivery it is possible to sell a security with your broker since you will ‘give’ it back to them at a later date, hopefully at a lower price.

Long vs. Short

Another great thing about the

Forex market is that you have more of a potential to profit in both rising and falling markets due to the fact that there is no market bias like the bullish bias of stocks. Anyone who has traded for a while knows that the fastest money is made in falling markets, so if you learn to trade both bull and bear markets you will have plenty of opportunities to profit.

LONG – When we go long it means we are buying the market and so we want the market to rise so that we can then sell back our position at a higher price than we bought for. This means we are buying the first currency in the pair and selling the second. So, if we buy the EURUSD and the euro strengthens relative to the U.S. dollar, we will be in a profitable trade.

SHORT – When we go short it means we are selling the market and so we want the market to fall so that we can then buy back our position at a lower price than we sold it for. This means we are selling the first currency in the pair and buying the second. So, if we sell the GBPUSD and the British pound weakens relative to the U.S. dollar, we will be in a profitable trade.

Order types

Now it’s time to cover order types. When you execute a trade in the Forex market it is called an ‘order’, there are different order types and they can vary between brokers. All brokers provide some basic order types, there are other ‘special’ order types that are not offered by all brokers though, and we will cover them all below:

Market order – A market order is an order that is placed ‘at the market’ and it’s executed instantly at the best available price.

Limit Entry order – A limit entry order is placed to either buy below the current market price or sell above the current market price. This is a bit tricky to understand at first so let me explain:

If the EURUSD is currently trading at 1.3200 and you want to go sell the market if it reaches 1.3250, you can place a limit sell order and then when / if the market touches 1.3250 it will fill you short. Thus, the limit sell order is placed ABOVE current market price. If you want to buy the EURUSD at 1.3050 and the market is trading at 1.3100, you would place your limit buy order at 1.3050 and then if the market hits that level it will fill you long. Thus the limit buy order is placed BELOW current market price.

Stop Entry order – A stop-entry order is placed to buy above the current market price or sell below it. For example, if you want to trade long but you want to enter on a breakout of a resistance area, you would place your buy stop just above the resistance and you would get filled as price moves up into your stop entry order. The opposite holds true for a sell-stop entry if you want to sell the market.

Stop Loss order – A stop-loss order is an order that is connected to a trade for the purpose of preventing further losses if the price moves beyond a level that you specify. The stop-loss is perhaps the most important order in Forex trading since it gives you the ability to control your risk and limit losses. This order remains in effect until the position is liquidated or you modify or cancel the stop-loss order.

Trailing Stop – The trailing stop-loss order is an order that is connected to a trade like the standard stop-loss, but a trailing stop-loss moves or ‘trails’ the current market price as your trade moves in your favor. You can typically set your trailing stop-loss to trail at a certain distance from current market price, it will not start moving until or unless the price moves greater than the distance you specify. For example, if you set a 50 pip trailing stop on the EURUSD, the stop will not move up until your position is in your favor by 51 pips, and then the stop will only move again if the market moves 51 pips above where your trailing stop is, so this way you can lock in profit as the market moves in your favor while still giving the trade room to grow and breath. Trailing stops are best used in strong trending markets.

Good till Cancelled order (GTC) – A good till cancelled order is exactly what it says…good until you cancel it. If you place a GTC order it will not expire until you manually cancel it. Be careful with these because you don’t want to set a GTC and then forget about it only to have the market fill you a month later in a potentially unfavorable position.

Good for the Day order (GFD) – A good for day order remains active in the market until the end of the trading day, in Forex the trading day ends at 5:00pm EST or New York time. The exact time a GFD expires might vary from broker to broker, so always check with your broker.

One Cancels the Other order (OCO) – A one cancels the other order is essentially two sets of orders; it can consist of two entry orders, two stop loss orders, or two entry and two stop-loss orders. Essentially, when one order is executed the other is cancelled. So, if you want to buy OR sell the EURUSD because you are anticipating a breakout from consolidation but you don’t know which way the market will break, you can place a buy entry and stop-loss above the consolidation and a sell entry with stop-loss below the consolidation. If the buy entry gets filled for example, the sell entry and its connected stop loss will both be cancelled instantly. A very handy order to use when you are not sure which direction the market will move but are anticipating a large move.

One Triggers the Other order (OTO) – This order is the opposite of an OCO order, because instead of cancelling an order upon filling one, it will trigger another order upon filling one.

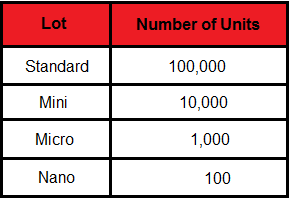

Lot size / Contract size

In Forex, positions are quoted in terms of ‘lots’. The common nomenclature is ‘standard lot’, ‘mini lot’, ‘micro lot’, and ‘nano lot’; we can see examples of each of these in the chart below and the number of units they each represent:

How to calculate pip value

You probably already know that currencies are measured in pips, and one pip is the smallest increment of price movement that a currency can move. To make money from these small increments of price movement, you need to trade larger amounts of a particular currency in order to see any significant gain (or loss). This is where leverage comes into play; if you don’t understand leverage totally please go read Part 1 of the course where we discuss it.

So we need to know now how lot size affects the value of one pip. Let’s work through a couple examples:

We will assume we are using standard lots, which control 100,000 units per lot. Let’s see how this affects pip value.

1) EUR/JPY at an exchange rate of 100.50 (.01 / 100.50) x 100,000 = $9.95 per pip

2) USD/CHF at an exchange rate of 0.9190 (.0001 / .9190) x 100,000 = $10.88 per pip

In currency pairs where the U.S. dollar is the quote currency, one standard lot will always equal $10 per pip, one mini-lot will equal $1 per pip, one micro-lost will equal .10 cents per pip, and a nano-lot is one penny per pip.

How to calculate profit and loss

Now, let’s move on to calculating profit and loss:

Let’s use a pair without the U.S. dollar as the quote currency since these are the trickier ones:

1) The rate for the USD/CHF is currently quoted at 0.9191 / 0.9195. Let’s say we are looking to sell the USD/CHF, this means we will be working with the ‘bid’ price of 0.9191, or the rate at which the market is prepared to buy from you.

2) You then sell 1 standard lot (100,000 units) at 0.9191

3) A couple of days later the price moves to 0.9091 / 0.9095 and you decide to take your profit of 96 pips, but what dollar amount is that??

4) The new quote price for the USD/CHF is 0.9091 / 0.9095. Since you are now closing the trade you are working with the ‘ask’ price since you are going to buy the currency pair to offset the sell order you previously initiated. So, since the ‘ask’ price is now 0.9095, this is the price the market is willing to sell the currency pair to you, or the price that you can buy it back at (since you initially sold it).

5) The difference between the price you sold at (0.9191) and the price you want to buy back at (0.9095) is 0.0096, or 96 pips.

6) Using the formula from above, we now have (.0001 / 0.9095) x 100,000 = $10.99 per pip x 96 pips = $1055.04

For currency pairs where the U.S. dollar is the quote currency, calculating profit or loss is pretty simple really. You simply take the number of pips you gained or lost and multiple that by the dollar per pip you are trading, here’s an example:

Let’s say you trade the EURUSD and you buy it at 1.3200 but the price moves down and hits your stop at 1.3100….you just lost 100 pips.

If you are trading 1 standard lot you would have lost $1,000 because 1 standard lot of pairs with the U.S. dollars as the quote currency = $10 per pip, and $10 per pip x 100 pips = $1,000

If you had traded 1 mini-lot you would have lost $100 since 1 mini-lot of USD quote pairs is equal to $1 per pip and $1 x 100 pips = $100

Always remember: when you enter or exit a trade you have to deal with the spread of the bid/ask price. Thus, when you buy a currency you will use the ask price and when you sell a currency you use the bid price.